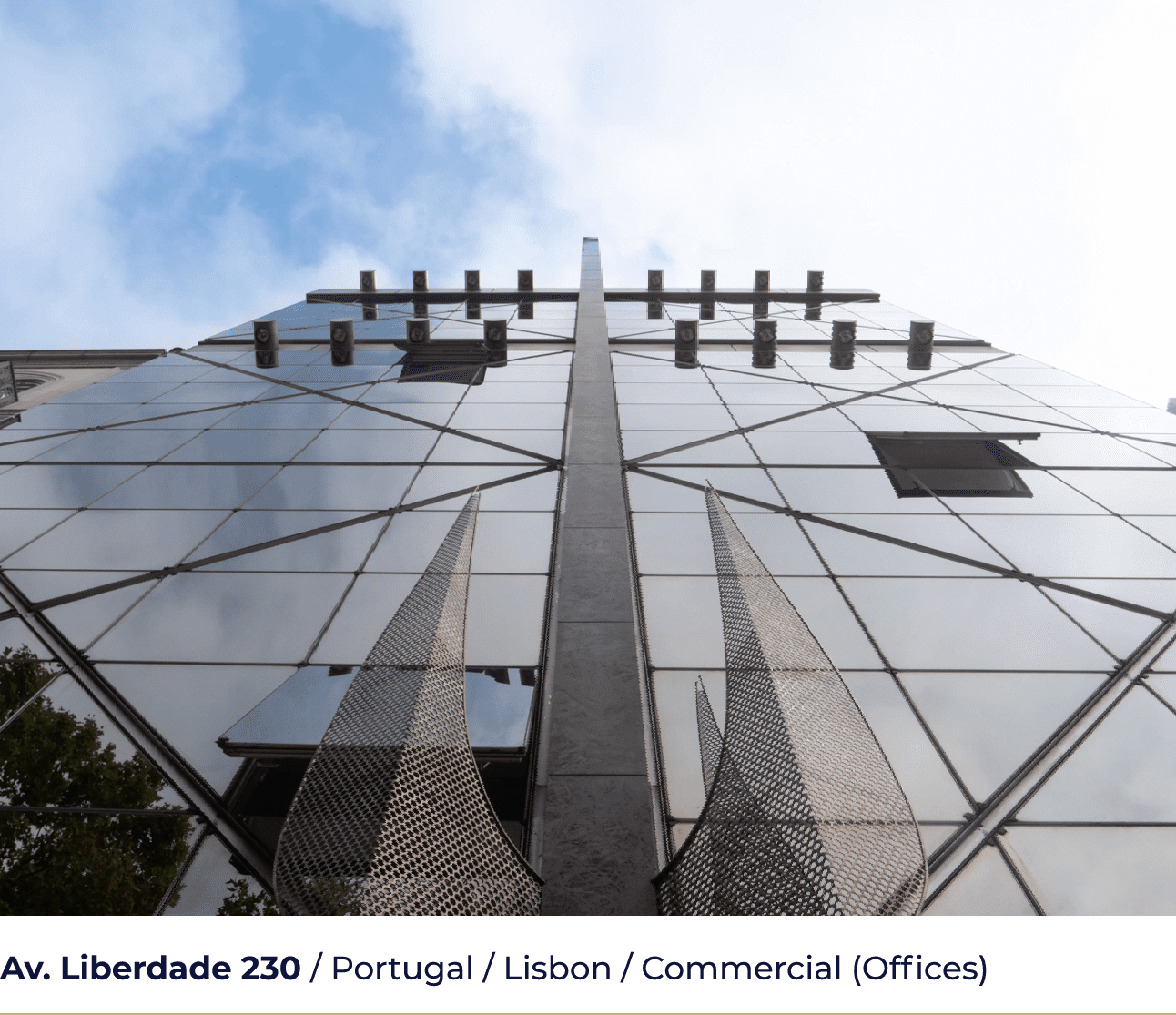

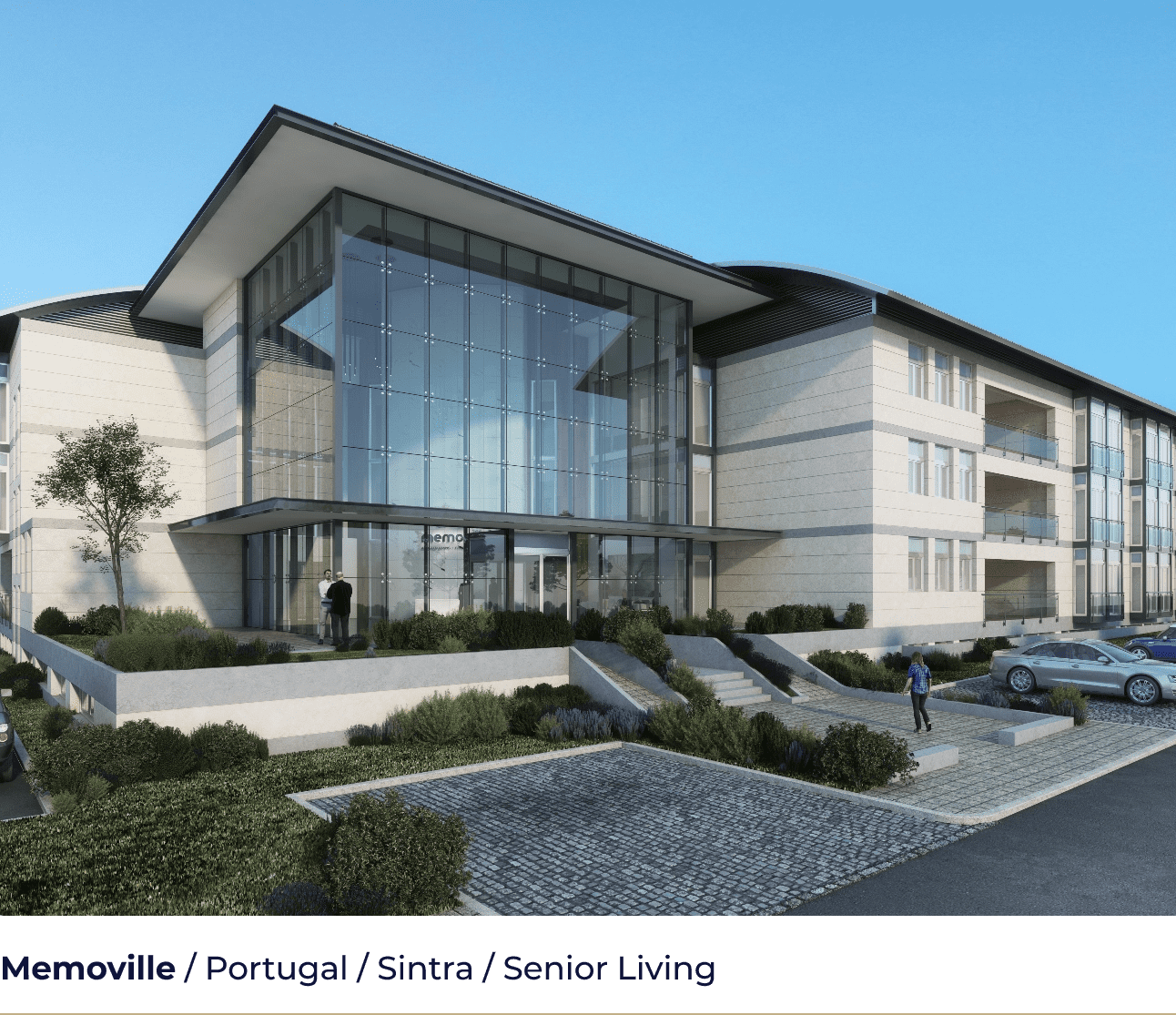

Villanova was created by a group of investor-operators, experienced investors in real estate, with decades of accumulated experience in commercial and residential segments, who also own and operate the businesses that generate the assets’ income, such as nursing homes and office buildings.

This means not only our partners invested their own money, making their interests entirely aligned with outside investors, but also that they have the necessary expertise and experience to ensure predictable and sustainable returns in the short and long term.

Villanova’s success is based on the BF Group’s decades of operational experience in different businesses.

Jorge Fonseca and António Silva Founder and CEO of BF Group, Villanova Core Investors

BF Group

The group’s origins can be traced back to 1983, when founder Jorge Fonseca created his first marketing services company in Toronto, Canada. Since then, BF hasn’t stopped growing and diversifying its operations across the globe. In the past 20 years, the original marketing services division acquired over 4 million clients for its business partners and spread in over 100 cities in Europe and the Americas, and the group has successfully ventured into real estate, healthcare, consumer products, hospitality and senior living, where it is one of the main operators in the Portuguese market.